Portfolio Risk Calculator

The Portfolio Risk Calculator is only available on Investor Compass 2.0. If you are unsure of what version of Investor Compass you are currently using, please visit this guide.

An innovative component of the Investor Compass solution, Portfolio Risk Calculator quickly and easily displays current asset allocations and projections for a portfolio within the established risk parameters. Review and evaluate risk levels and projections by amending asset allocations in the client’s portfolio to clearly evidence your suitability process. On this article you will find information about the below topics:

- Current portfolio and Proposed Portfolio

- Adding and editing assets

- Aggregate risk level

- Projections

- Portfolio Risk Calculator for clients who had completed the Financial Circumstances and Goals assessment

- Portfolio Risk Calculator for clients who has not done an FCG

Current Portfolio and Proposed Portfolio

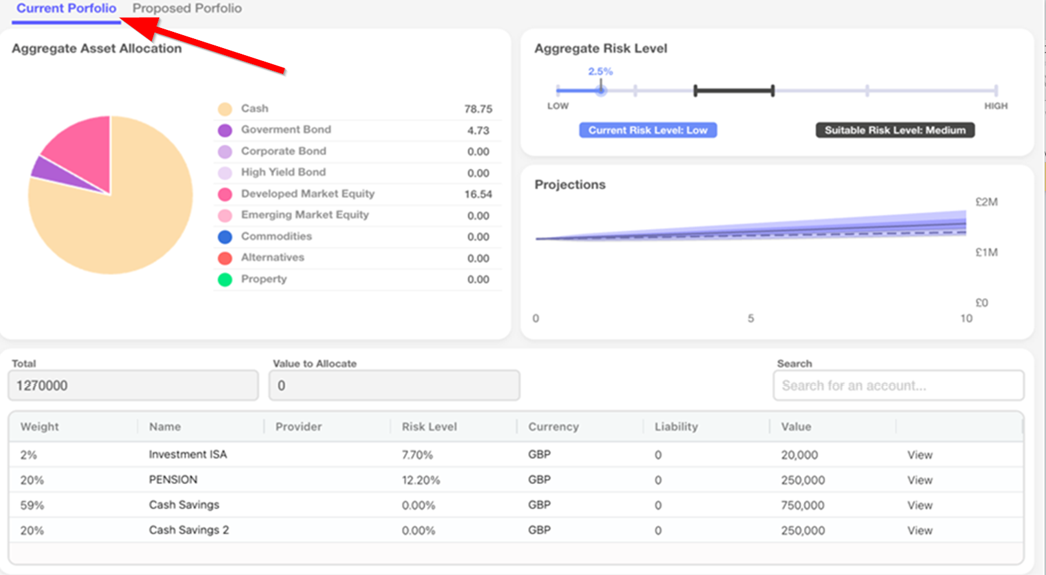

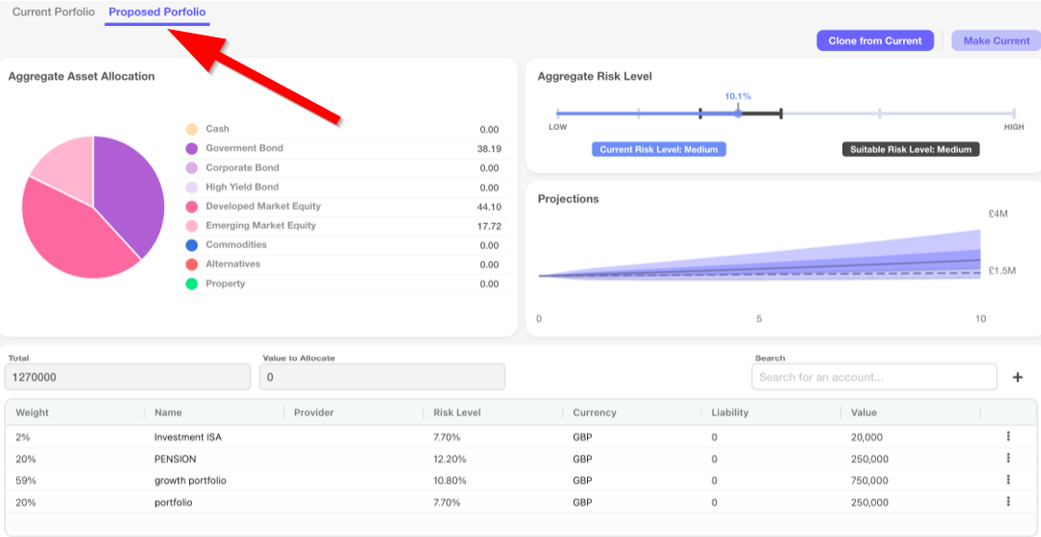

You will see 2 tabs at the top of the Portfolio Risk Calculator screen. These are your Current and Proposed portfolios. This will allow you to easily demonstrate and evidence the benefits of your proposed solution to your client’s current position.

Adding and editing assets

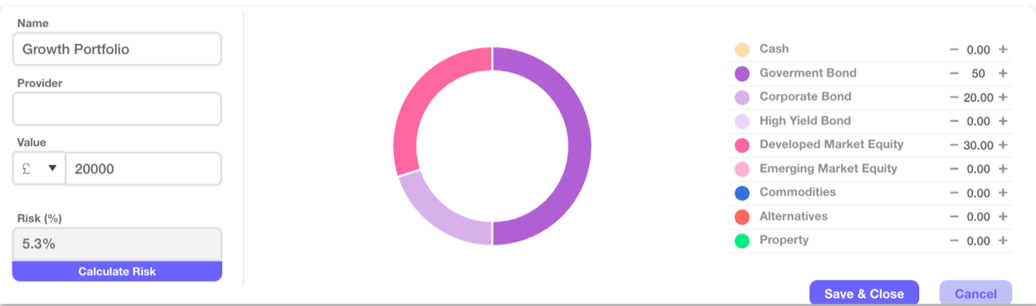

- Calculate the risk level of any fund or portfolio using the underlying asset allocations

- Create investments from underlying asset allocations to calculate a specific risk level

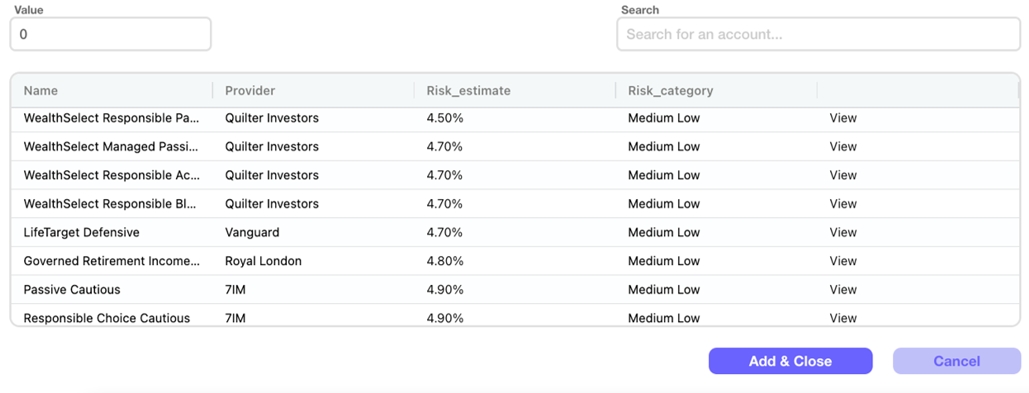

Select from our range of mapped funds

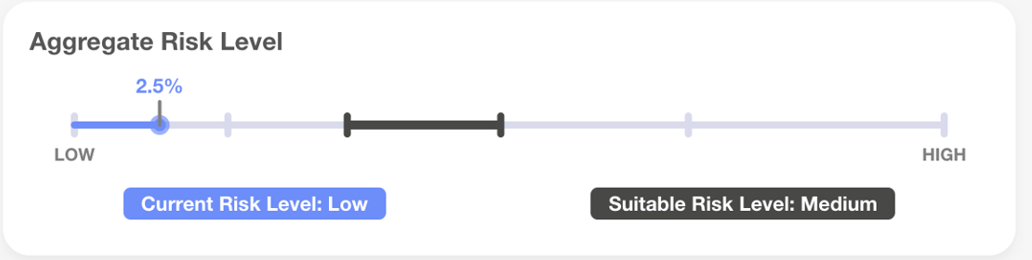

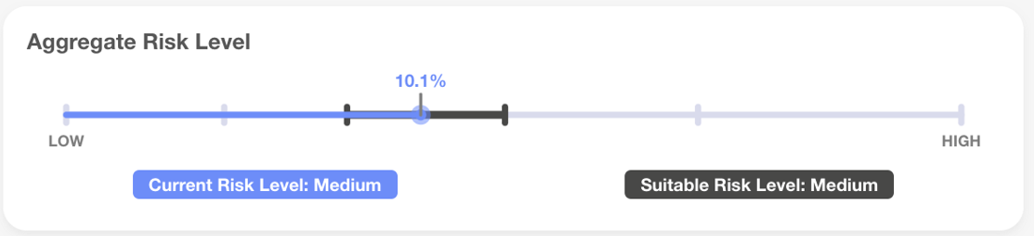

Aggregate risk level

View your portfolios’ aggregate risk level compared to the client’s suitable risk level

Projections

Visualise the long-term potential projections for your clients’ investments with optional future layers

Portfolio Risk Calculator for clients who had completed the Financial Circumstances and Goals assessment

- When you use Portfolio Risk Calculator for the first time with a client, you will see their cash, investment and pension accounts

- Cash accounts will already have an asset allocation (100% cash), but investment and pension accounts will need to have their asset allocations set to produce accurate results in the pie chart, current risk and projection sections.

- To provide the asset allocations for the first time, you need to create a proposed portfolio.

- Clone the current portfolio in the proposed tab.

- View an account and provide the missing details (e.g. provider name and asset allocation). You can also update the values if necessary.

- Alternatively, you can remove an account and replace it by adding a mapped account. This allows you to use a fund from our library of mapped funds.

- When you have finished providing information about the current portfolio, make the proposed portfolio current.

- Review the current portfolio’s aggregate asset allocation, compare the current and suitable (or agreed) risk level, and the projections chart.

- If you want to propose changes to the portfolio, repeat the process of cloning the current portfolio on the proposed tab. You can then discuss the current and proposed portfolios with the client.

Portfolio Risk Calculator for clients who has not done an FCG

- When you use Portfolio Risk Calculator for the first time with a client, you will need to provide information about their investment accounts. If you haven’t done this using the financial circumstances and goals assessment, you can add accounts directly from within Portfolio Risk Calculator.

- To add accounts for the first time, open the proposed tab to start a new draft portfolio.

- Add a mapped investment to choose from our library of risk-mapped portfolios.

- Or create an account with a custom asset allocation and enter the details manually.

- When you have finished providing information about the current portfolio, make the proposed portfolio current.

- Review the current portfolio’s aggregate asset allocation, compare the current and suitable (or agreed) risk level, and the projections chart.

- If you want to propose changes to the portfolio, repeat the process of cloning the current portfolio on the proposed tab. You can then discuss the current and proposed portfolios with the client.