Release Notes v4.12 - 2024-11

Highlights

- New user interface for adviser/assistants and admin view screens

- New Login user interface for advisers /assistants and administrators

- Attention: Bulk edit of clients’ status has been removed for maintenance and will return in 2025. To archive client individually please follow these steps.

Web app changes

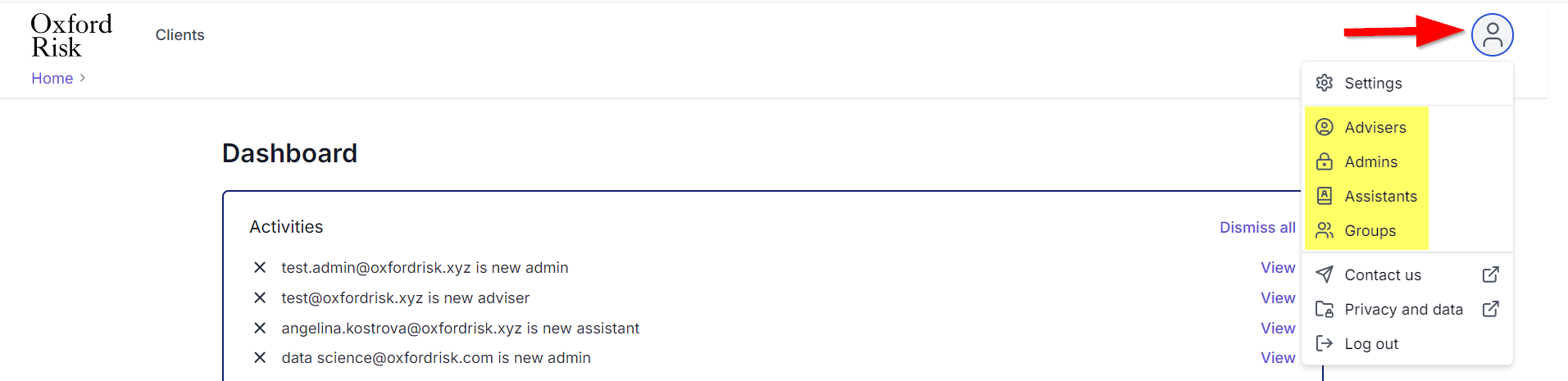

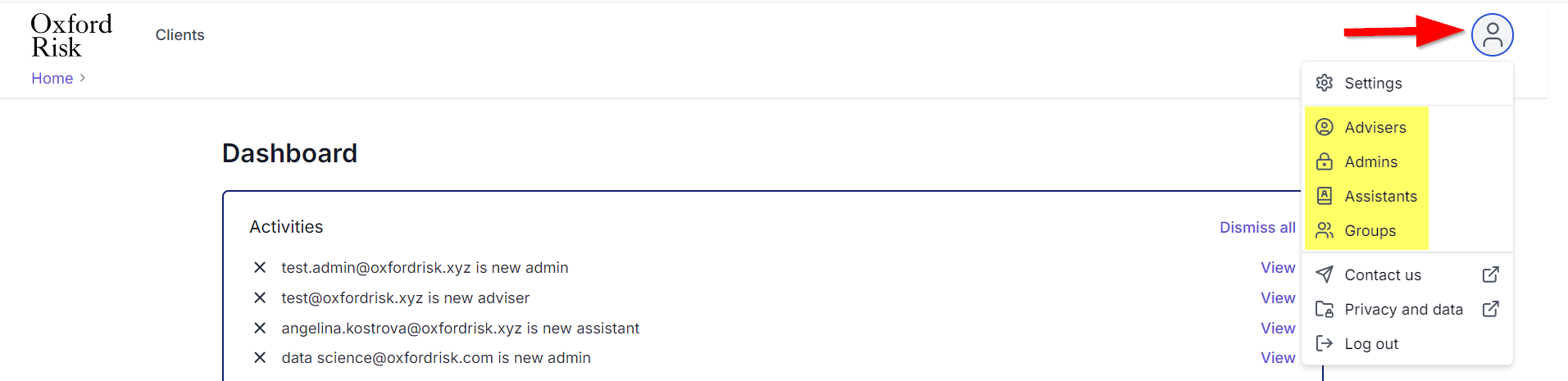

- New Your account menu look

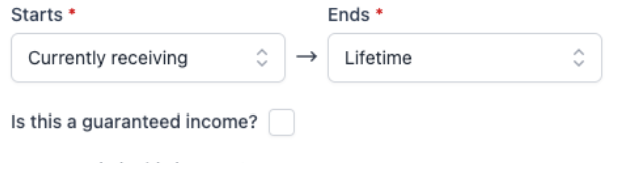

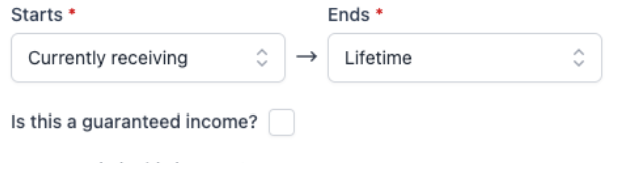

- Financial Circumstances and goals assessment: New data options have been added to the income section of the assessment:

- Income End-date option - ‘Currently Ongoing’ has now been renamed ‘Lifetime’

- New tick box to specify if the income is a guaranteed income (this will support future Secure Lifetime income calculation feature)

Adviser Screen

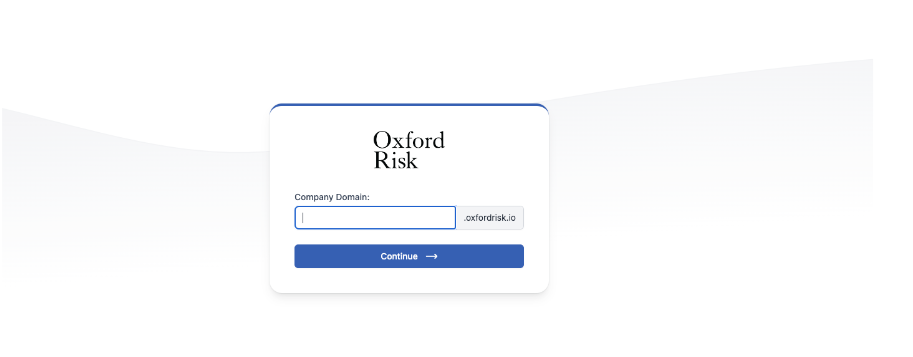

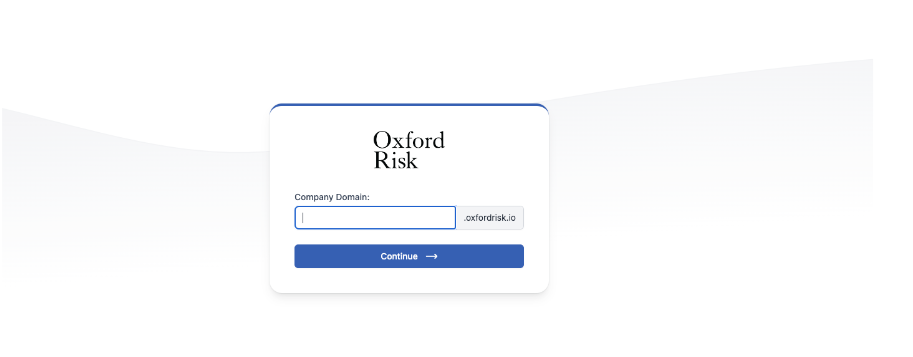

- New generic login page - id.oxfordrisk.com, to allow you to search company domain. Simply type the first part of your company domain (the subdoimain) and click Continue.

- i.e. For a company called "Example Advisory" the domain will be Exampleadvisory.oxfordrisk.io, therefore, the user will have to type Exampleadvisory on the search bar below.

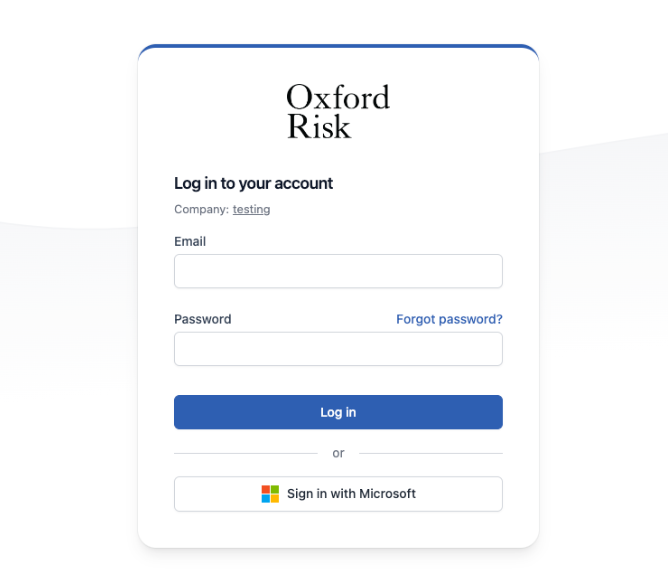

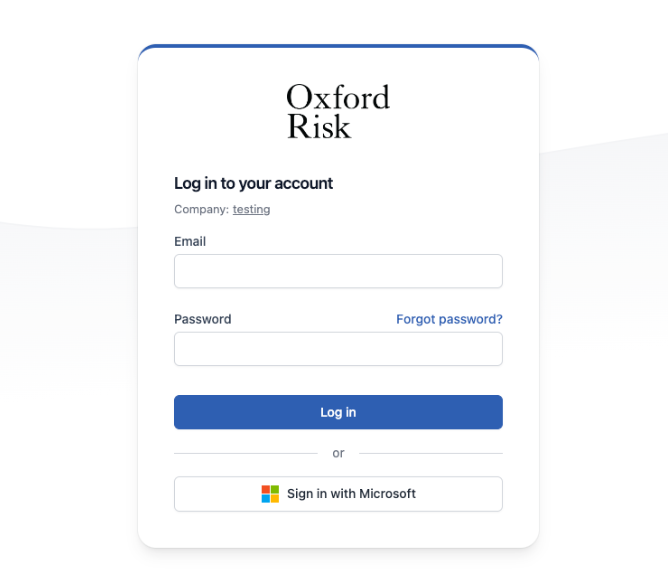

- Improved User Interface for login screens.

- Visually improved adviser screens.

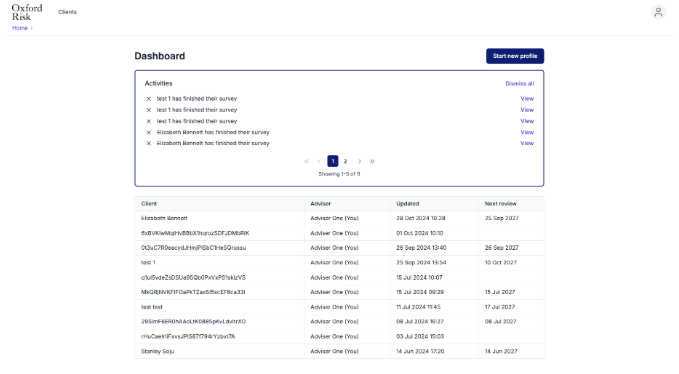

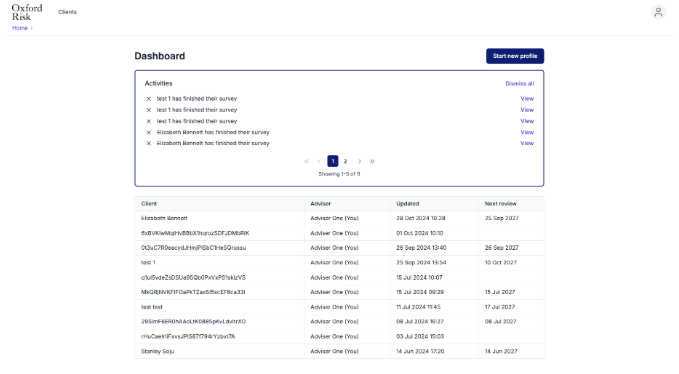

- New Dashboard

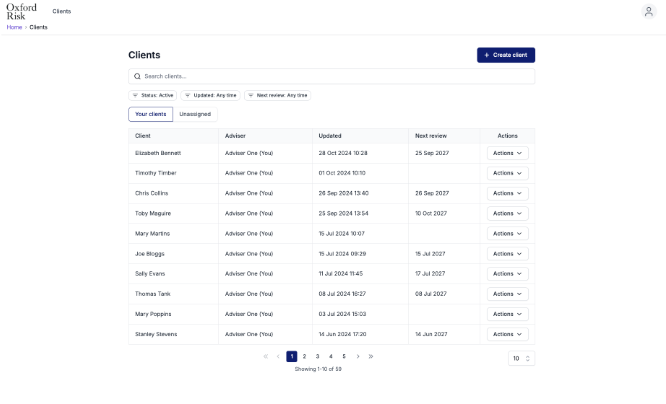

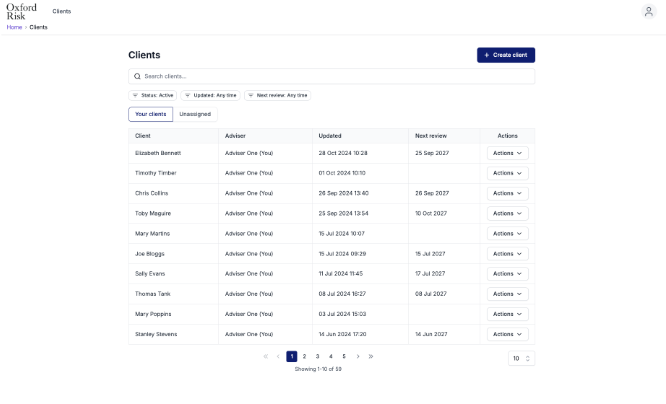

- New Client table

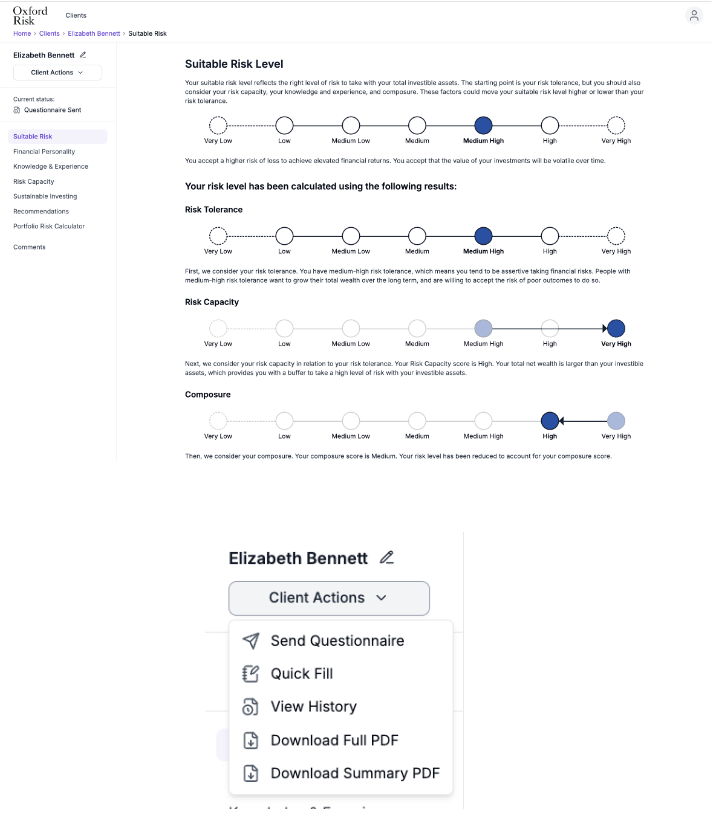

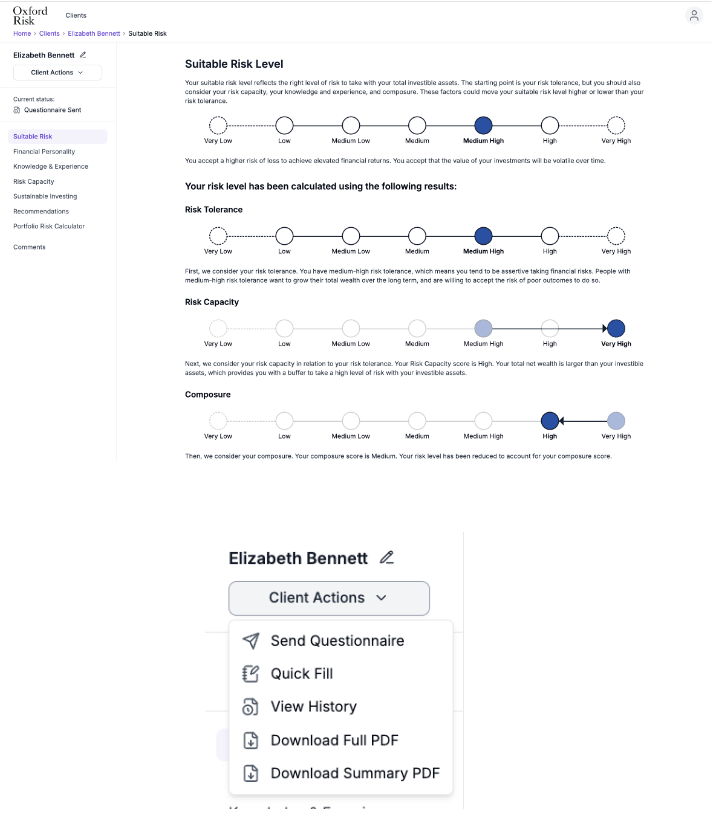

- New Client results view:

- Side menu has been reordered to prioritise Suitable risk level

- Send profile has been renamed to send questionnaire

- Edit client details is now completed by selecting the edit icon next to the clients name

- Bulk edit actions have been removed for maintenance and redesign. This feature is expected to return to the tool in 2025. To change client status please follow these steps.

Admin Screen

- Users and Groups tab is now in "your account menu"

API Changes

- New finance microservice endpoints for future Secure lifetime income feature :

- Calculate affordability:

- This endpoint allows you to submit accounts, cashflows and a suitable risk level and in return get 4 scenarios based on growth.

- Longevity and JUST SLI rate:

- This endpoint allows you to submit date of birth, gender, post code and a target yearly contribution and in return get an expected longevity and an SLI rate.

- Guaranteed Income endpoint:

- This endpoint will calculate a recommended annual income and an expected cost of that annual income if you were to buy an SLI

- Ghost assets can now be dampened properly with new non investible attributes (flexibility and importance)

- Currencies are now updated daily

Documentation